Ford Puma Finance Guide: Monthly Costs, HP Options & How to Apply

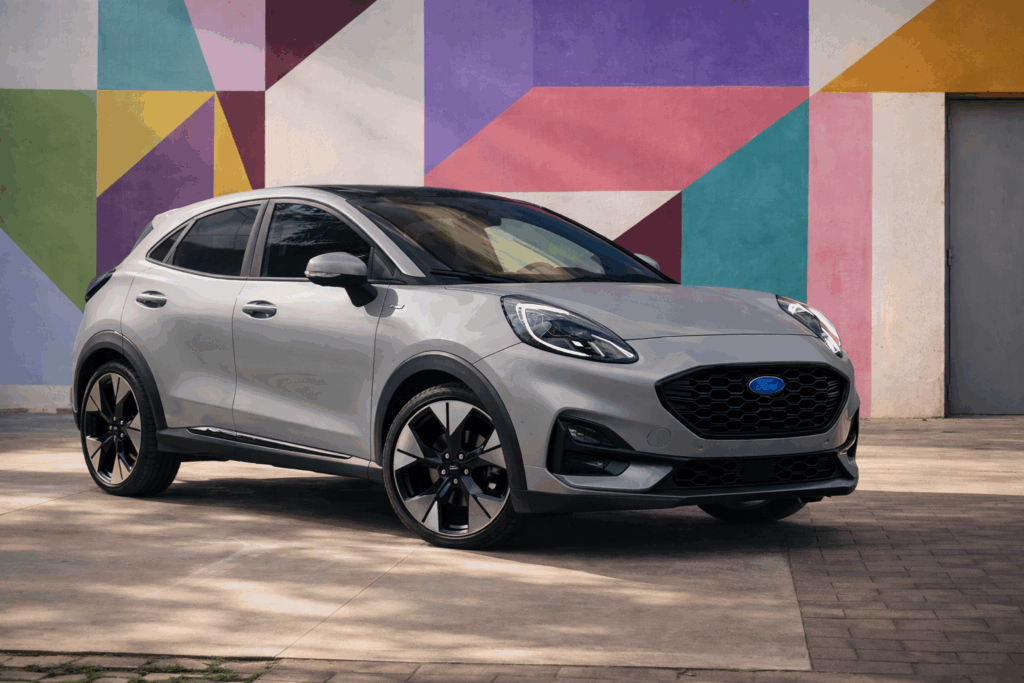

The Ford Puma has become one of the UK’s most popular small SUVs. It’s practical without feeling bulky, cheap to run, and modern enough inside that it doesn’t feel like a compromise. For a lot of buyers, it hits that sweet spot.

Once you’ve decided the Puma is the right car, the next question is usually straightforward: how much does Ford Puma finance actually cost per month?

This guide focuses on Ford Puma HP finance, breaking down realistic monthly payments, deposit options, used versus new costs, and how the Motorly application process works using a soft credit check that won’t affect your score. No jargon. No inflated promises. Just the numbers and how they tend to work in the real world.

If you’re still comparing models, you can also browse our wider range of SUV car finance options to see how the Puma stacks up against similar cars.

How Much Does Ford Puma Finance Cost Per Month?

There isn’t a single monthly figure for Ford Puma finance, because the cost depends on a few key choices you make along the way.

In practice, Ford Puma monthly cost is shaped by:

- Whether the car is new or used

- The price of the vehicle and trim level

- Your deposit, if any

- How long you spread the finance over

Motorly offers Hire Purchase (HP) finance for the Ford Puma. With HP, you’re financing the full value of the car and you own it outright once the final payment is made. There’s no balloon payment and no decision to make at the end.

New Ford Puma on HP

A brand-new Ford Puma currently starts from around £26,580 OTR, depending on trim and specification.

Because HP doesn’t defer part of the cost until the end, monthly payments on a new Puma tend to be higher than some other finance types. The trade-off is clarity — you know exactly what you’re paying and when the car becomes yours.

As a realistic guide, new Ford Puma HP finance often falls into this range:

- Around £300 to £450 per month

- Finance terms typically 36 to 60 months

- Deposits from £0 to £2,000+, subject to status

Exact figures vary based on APR, term length, and eligibility, but HP keeps things simple: fixed payments and no surprises.

Used Ford Puma on HP

For many buyers, this is where the value really is.

The Ford Puma has only been on sale since 2019, which means even used examples are still modern, efficient, and well equipped. You’re not looking at outdated tech or tired interiors.

Typical used Ford Puma HP finance payments often look like:

- Roughly £180 to £320 per month

- Vehicle prices commonly between £12,000 and £18,000

- Finance terms of 36 to 60 months

- Optional deposits, including £0 deposit options where available

HP works particularly well for used cars. You’re spreading the cost of a lower-priced vehicle and still owning it outright at the end, with no mileage limits or end-of-term decisions.

Ford Puma HP Finance: New vs Used

| Option | Typical Car Price | Deposit | Monthly Cost (HP) | Term | Ownership |

|---|---|---|---|---|---|

| New Ford Puma | £26,580+ | £0–£2,000+ | £300–£450 | 36–60 months | Own at end |

| Used Ford Puma | £12,000–£18,000 | £0–£1,000+ | £180–£320 | 36–60 months | Own at end |

If you’re choosing between a new or used Ford Puma on finance, the finance itself works the same way. The difference is mainly in the numbers.

A new Puma costs more upfront, which pushes monthly payments higher. A used Puma lowers the overall finance amount, often making payments far more manageable without sacrificing much in terms of features or reliability.

For many buyers, used HP finance offers the best balance — lower monthly cost, modern car, and full ownership at the end. If you’re looking for cheap Ford Puma finance, a used model on HP is typically the most affordable route.

👉 Check what you could pay on a Ford Puma with a soft credit check. No impact on your score.

Why Choose HP for a Ford Puma?

Hire Purchase suits Ford Puma buyers who value ownership and simplicity.

HP may be right for you if:

- You want to own the Puma outright at the end

- You plan to keep the car long term

- You drive higher mileage and don’t want limits

- You prefer fixed payments with no large final amount

Once the final payment is made, the car is yours. There’s no refinancing decision, no hand-back process, and no uncertainty.

Why HP Over Other Finance Types?

There are several ways to finance a car, but HP is often the most straightforward option for Ford Puma buyers.

Because you’re paying off the full value of the vehicle, HP suits drivers who want:

- Clear, predictable payments

- No mileage restrictions

- Full ownership without a final lump sum

For a practical, everyday SUV like the Puma, many buyers prefer knowing exactly where they stand from day one — how much they’re paying, how long for, and when the car becomes theirs.

Motorly focuses on ownership-based car finance, which is why HP is the core option offered for Ford Puma finance deals.

👉 See personalised Ford Puma HP payments in minutes.

What Deposit Do You Need for Ford Puma Finance?

Deposit is one of the biggest worries for buyers, but the reality is often simpler than expected.

Common deposit scenarios include:

- £0 deposit options, subject to status

- £500 to £1,000 to reduce monthly payments

- Larger deposits for buyers aiming for the lowest possible monthly cost

A deposit can improve eligibility and lower repayments, but it isn’t always required. Motorly offers no-deposit SUV finance options where available, making it easier to get started without upfront savings.

Ford Puma Trim Levels and What They Cost on Finance

Trim level affects the car price, which feeds directly into the monthly HP payment.

Titanium

Entry-level and usually the most affordable on finance. Used Titanium models often start from around £180–£220 per month.

ST-Line

Sportier styling and mid-range pricing. Used ST-Line models typically fall between £220–£280 per month.

ST-Line X

More tech and comfort features. Used examples often sit around £260–£310 per month.

ST

Performance-focused and highest priced. New ST models often cost £400–£450 per month on HP, with used examples around £300–£380.

As a rule: higher trim = higher car price = higher monthly payment. For many buyers, a used ST-Line offers the best balance of features and value.

Can You Finance a Used Ford Puma?

Yes — and it’s one of the most common ways people buy a Puma.

Because the model is still relatively new, used examples feel modern and are widely available. HP finance allows you to spread the cost while still owning the car outright at the end.

Motorly can help arrange used Ford car finance through approved dealers, giving you flexibility over where you buy.

Can You Get Ford Puma Finance With Bad Credit?

If your credit history isn’t perfect, you may still have options.

Motorly works with a panel of lenders, including those that specialise in bad credit car finance. The process starts with a soft credit check, so you can see what may be available without affecting your score.

Approval isn’t guaranteed, but many buyers with missed payments, defaults, or lower credit scores are still able to find a suitable option.

How to Apply for Ford Puma Finance With Motorly

The process is designed to be quick and low pressure:

- Check your eligibility using a soft credit check

- View personalised HP payment options

- Buy from any approved dealer with your pre-approved finance

There’s no obligation, and the initial check won’t impact your credit score.

👉 Apply for Ford Puma finance — decision in minutes.

Ford Puma Finance FAQs

What is the cheapest way to finance a Ford Puma?

Used Ford Puma HP finance is often the most affordable route, as the car price is lower and you still own it outright at the end.

How long can I finance a Ford Puma for?

Most HP agreements run for 36 to 60 months, depending on affordability and lender criteria.

Is HP a good option for a Ford Puma?

HP works well if you want ownership, fixed payments, and no mileage limits — especially if you plan to keep the car long term.

Can I part exchange my current car?

Yes. Many buyers use a part exchange as a deposit, which can reduce monthly payments.

What APR will I get on Ford Puma finance?

APR varies based on credit profile, deposit, and term. A soft check shows realistic options without affecting your score.