ten bad driving habits that are damaging your car

Car maintenance involves more than just regular services and MOTs. If you are guilty of any of the following, you could be causing unnecessary damage to your car that will result in large repair bills and a shortened life expectancy of your vehicle.

Resting your hand on the gear stick

Resting on the gear stick when you’re not using it to change gears can put additional strain on the transmission mechanics and cause premature wear and tear.

Riding on your breaks when going downhill

Resting your foot on the brakes as you are travelling downhill puts pressure on your braking system and can cause overheating. It’s better practice to shift down to a lower gear, allowing your engine to slow down at a more natural speed.

Riding the clutch

Overusing the clutch, e.g. when you are stationary at a traffic light or keeping it slightly depressed after changing gear, can cause damage to the clutch surfaces by causing them to graze against each other. Because the clutch is generally considered a ‘wear and tear’ component, it is not usually covered by any warranty and so having to get it replaced more often than is necessary can be extremely costly.

Braking too late

Excepting the occasions on which you need to perform an emergency stop, braking too late and abruptly on a regular basis will cause significant damage to your brake pads and discs. Not only are these expensive to replace, but harsh braking also burns much more fuel and produces additional harmful emissions.

Revving a cold engine

All car engines will be cold when they are first started up, so revving it immediately could cause sudden changes in temperature and consequently, damage to different parts. Allow your car to warm up gradually by putting it into neutral for a minute when you first switch the engine on.

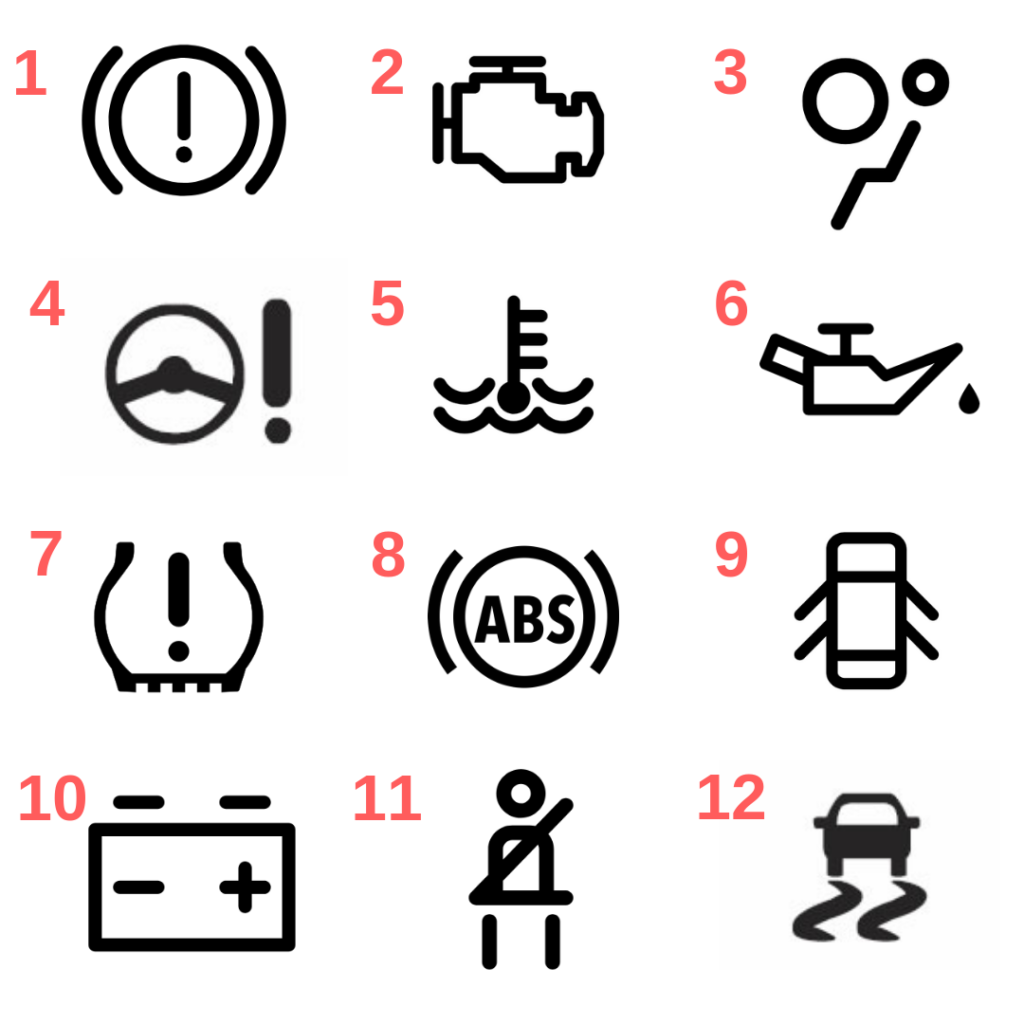

Ignoring warning lights

If something is wrong, your car will usually let you know about it through illuminated warning symbols on your dashboard. You shouldn’t ignore these and take your car to a garage as soon as possible in order to get the problem fixed. Likewise, if you notice anything else unusual, such as new sounds or vibrations you should seek specialist assistance.

Overloading your vehicle

Most cars will be able to handle a bit of extra weight, however, it’s important not to overload your car beyond its maximum capacity, which will be outlined in the owner’s manual. This is because any extra weight will put pressure on your brakes, suspension and transmission.

Keeping your fuel levels as low as possible

It is expensive to have your fuel tank constantly filled to the brim which is why many people choose to just fill it up as much as they’ll need for a journey however doing this could be damaging your car. Fuel pumps are susceptible to overheating when they’re not submerged, which in the long term can be damaging.

Shifting into reverse from drive when not stationary (Automatic cars)

In cars with automatic gearboxes, shifting between reverse and drive (and vice versa) without coming to a standstill first can have a big impact on the transmission band of the drive train. Unlike brake pads and discs, which are fairly simple to replace, any repairs on the automatic transmission are complicated and very expensive.

Potholes and speed bumps

Although drivers can’t control the condition of the roads they drive on, it is advisable to avoid or drive around potholes if it is safe to do so, or if not, drive very slowly and carefully over them. Hitting them at a speed can crack and buckle tyre alloys as well as produce lumps in the tyre, causing them to become unbalanced. Speed bumps should be treated with the same caution.

motorly is a credit broker, not a lender. Rates start from 6.9% APR. The rate you are offered will depend on your individual circumstances. Representative Example: Borrowing £5,500 over 48 months with a representative APR of 22.9% the amount payable would be £287 a month, with a total cost of credit of £1406 and a total amount payable of £6906.