dvla issues scam warning for motorists

The Driver and Vehicle Licensing Agency have released a warning against new scam emails and text messages, impersonating the DVLA with the aim of eliciting bank details from motorists.

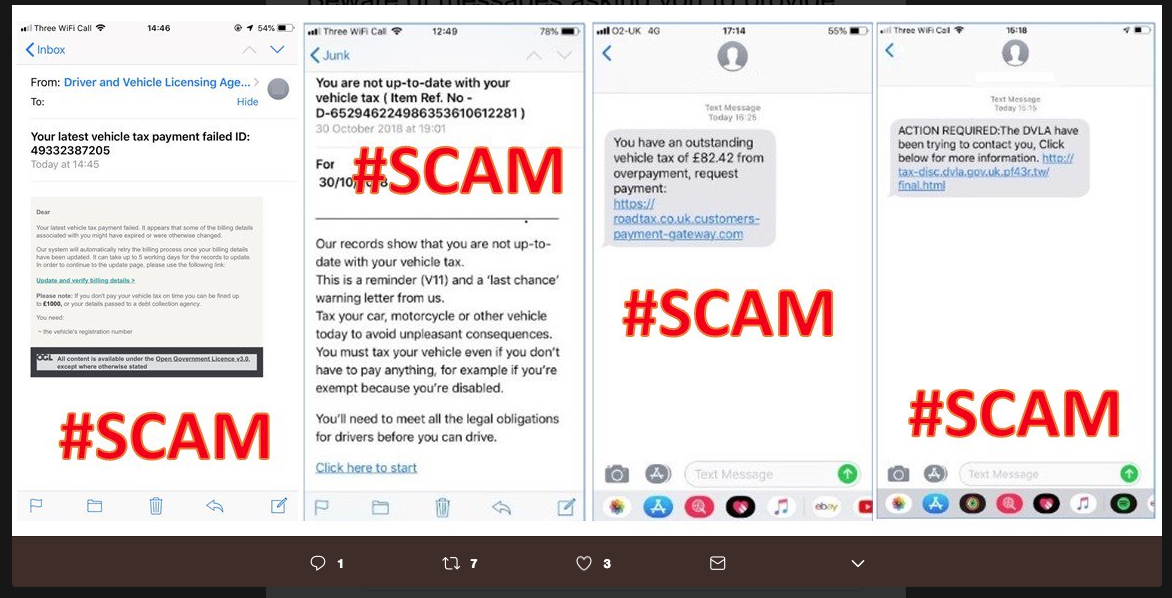

The messages being sent to motorists around the UK are designed to look like they are legitimate correspondence from the government organisation, notifying drivers that a vehicle tax payment has failed. The message explains that an invalid, expired or altered billing detail is the cause of the failed payment and that drivers could face a fine of up to £1,000 if vehicle tax payments are not made on time. The message also contains a hyperlink which leads the recipient to a false website where they are prompted to enter their bank details.

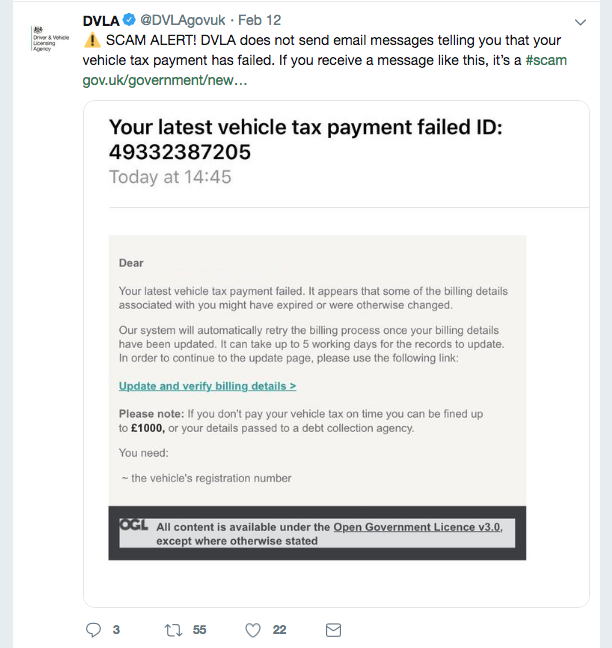

The DVLA shared an image of the fraudulent message on its social media profiles:

The DVLA has confirmed that this is not a genuine message and has not come from them. It has stated that it does not send out emails or text messages that ask customers to verify personal details or provide payment information and has advised anyone who receives this message to not click on any links and delete the email or text straight away.

In its official statement, the DVLA has also issued a general warning to customers about searching for the DVLA website through Google as there are a number of third-party websites falsely claiming to be the DVLA. These websites might be offering things like help with applying for a driving license or taxing your car. A tell-tale sign that you are being misled is if the website is asking for fees for services that can be obtained for free (or at a lower cost) on Gov.uk. Don’t be fooled by details such as having “dvla” in the website URL or the use of DVLA logos.

motorly is a credit broker, not a lender. Rates start from 6.9% APR. The rate you are offered will depend on your individual circumstances. Representative Example: Borrowing £5,500 over 48 months with a representative APR of 22.9% the amount payable would be £287 a month, with a total cost of credit of £1406 and a total amount payable of £6906.