car insurance extras – which ones do you actually need?

When comparing insurance quotes, you’ll often be given the option to add on what is known as “ancillaries” that provide additional cover to the standard third-party/ comprehensive/ multi-car policy that you pick. These extras are both general and more specific so that you can pick and choose the types of cover that you think you could need, depending on your lifestyle, the kinds of journeys you make, where you leave your car parked at night etc. Below, we will outline what each extra is and what kinds of situations they cover:

Breakdown Cover

Having breakdown cover will guarantee that in the event of a breakdown, you will be able to get roadside assistance and not be stranded. Few insurers will include breakdown cover as part of their policies and so usually it will have to be added on or purchased separately from another provider – therefore it’s a good idea to have a look around for different deals before you add it on. You should also take into account that the level of breakdown cover provided will vary between insurance providers and so ensure that you are getting the right cover to suit your needs. Breakdown cover will usually fall into these categories:

- Roadside assistance

- Recovery/relay – if your car can’t be fixed at the roadside and needs to go to a garage.

- Home start – if you break down at home.

- Onward travel – if you breakdown far away from home and your car needs significant repairs, you may be given a replacement hire car, overnight accommodation or onward travel expenses.

- European cover – when driving in Europe up to a limit of 31 days at a time and 90 days a year in total.

Windscreen Cover

Windscreen cover will allow you to recover the costs of any repairs to your windscreen as a result of chips or cracks, or even the cost of an entire windscreen replacement if necessary. Even though it is called “windscreen” cover, it will often cover any other windows in your car and sometimes sunroofs too. The majority of comprehensive car insurance policies will already include windscreen cover and you might have to pay an excess, although this will vary from policy to policy.

Legal Cover

Legal cover provides you with financial protection against any costs you may incur from making a claim against another driver, or another driver making a claim against you in the event of an accident. Legal cover might be included in some policies but not always and is usually capped at a value of £50,000 (although you should check this with your insurer). Legal Cover can provide protection against the following uninsured losses:

- Loss of earnings,

- Transport fees,

- Personal injury,

- The excess on your policy.

Driving abroad / Green card

Most UK car insurance policies will cover you by the minimum compulsory requirement for driving in any other EU countries although this usually won’t include things like theft and fire damage. With regards to Britain’s departure from the European Union this year, it is not yet known what effect this might have on car insurance policies covering UK motorists in Europe, so if you have a trip planned it is best to contact your insurer about any questions you have. It has been widely speculated that in the event of a no-deal, UK drivers will need to be in possession of a green card if they are going to be driving in the EU, which proves that your policy provides the minimum, third party cover. These are free to acquire, so it is worth getting one just in case. Read more about the effects of Brexit on the car industry and UK car drivers in our blog post here.

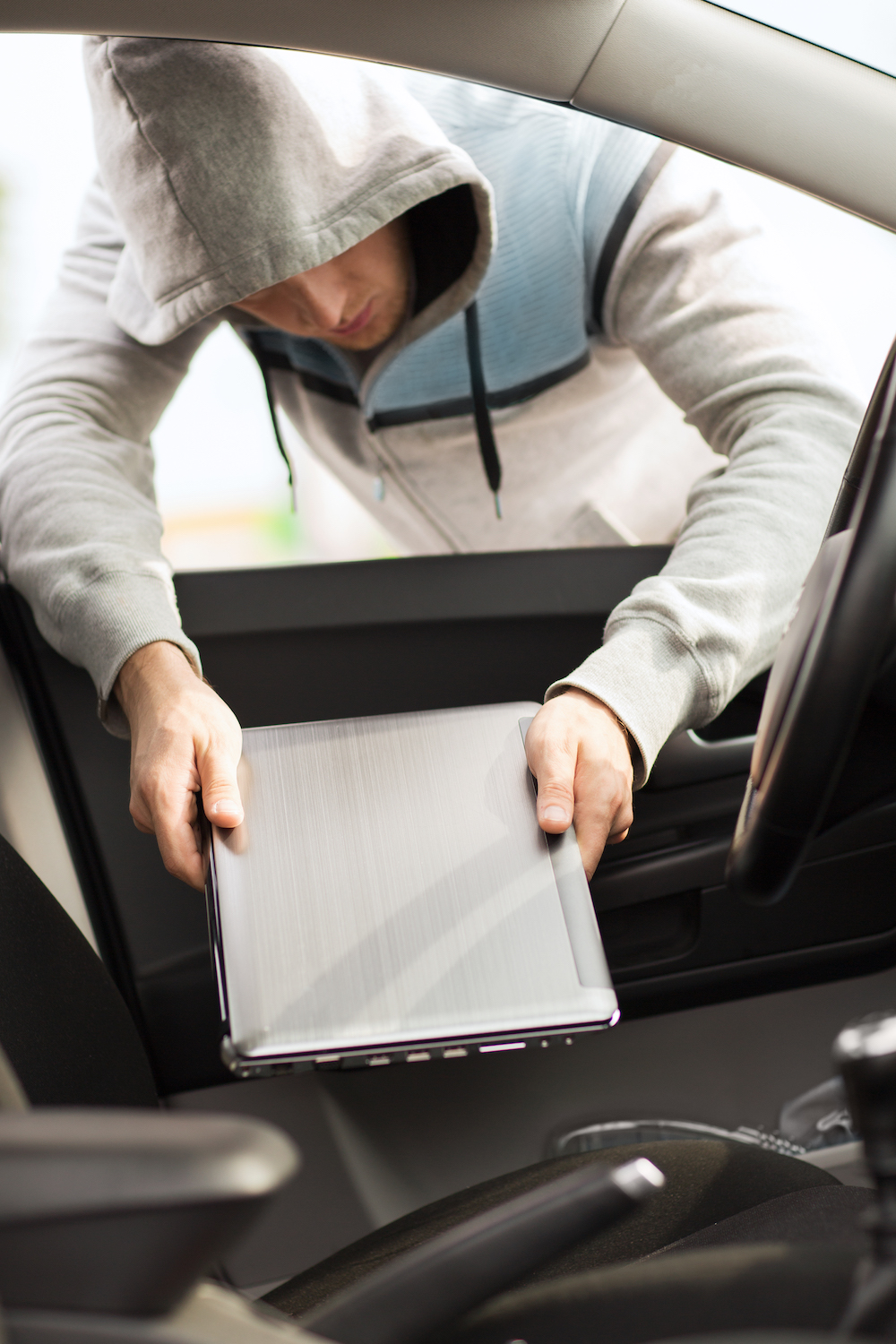

Personal Effects Cover

The majority of comprehensive policies will include cover for any personal belongings inside your vehicle that are damaged in an accident or stolen from your car. This kind of cover is much less common with third party, fire and theft policies. Depending on your insurer and the policy, the value of items that will be covered can vary anywhere between £50 and £500. Bear in mind that many insurers will include certain clauses that mean that you might not always be able to claim, such as there must be signs of forced entry and items must be stowed away in the glove box or boot, not left in plain view. Because there are a number of limits and exclusions on Personal Effects Cover for car insurance, many people will choose to cover their personal belongings through Home Contents insurance instead, which itself will have an option to cover personal possessions outside of the home (i.e. in your car).

When it comes to getting cover for your in-car stereo and sat nav equipment, most insurers will treat factory fitted systems differently to separately installed systems so you need to disclose this to them. Non-manufacturer equipment is usually considered to be a modification and therefore you may experience higher premiums as a result.

Lost/stolen keys

Replacement key cover is included as a standard part of some insurance policies but not all and the level of cover available will vary between policies and insurers. Most of the time you will not have to pay an excess when you make a claim for lost or stolen keys and it usually won’t affect your no claims bonus either. Usually, you will be able to recover any costs relating to lost, stolen or broken keys up to a value of £1500 and some policies will even cover the cost of a hire car and transference of your vehicle if you are left without your keys far away from home.

Uninsured driver protection

Uninsured Driver Protection will cover you in the event that you are in an accident with an uninsured driver so that you won’t have to pay an insurance excess, lose your no claims bonus and in some cases, pay for repairs to your car yourself. In order to claim, you will have to provide the details of the uninsured vehicle as well as adequate proof that the accident was not your fault.

Personal Accident Cover

Personal accident and injury cover on car insurance is in place to provide compensation in the event of death or significant injury as a result of being in a car accident when you are unable to claim from a third party. Each policy will specify the kinds of injuries that are covered and compensation is usually capped at a maximum of £5000. Various policies will also have certain clauses and exclusions, for example, sometimes only the driver and his/her spouse will be covered and some policies will even exclude older people over a certain age.

There are a variety of different extras on offer so it’s important to conduct thorough research before deciding whether to add any on. Some are more useful than others and it really depends on your specific requirements, i.e. there’s no need to add on European cover if you don’t plan to be driving abroad within the next year! On the other hand, breakdowns can happen to almost anybody at any time due to a number of various problems, so with extras like breakdown cover, it is definitely a case of being safe than sorry.

motorly is a credit broker, not a lender. Rates start from 6.9% APR. The rate you are offered will depend on your individual circumstances. Representative Example: Borrowing £5,500 over 48 months with a representative APR of 22.9% the amount payable would be £287 a month, with a total cost of credit of £1406 and a total amount payable of £6906.